What are Liabilities?

Liabilities are obligations to provide resources such as goods, services, or currency to satisfy outstanding debt.

Formal definitions by regulatory bodies include:

“An amount owed to a person or organization for borrowed funds. Loans, notes, bonds, and mortgages are forms of debt. These different forms all call for borrowers to pay back the amount they owe, typically with interest, by a specific date, which is set forth in the repayment terms.” -U.S. SEC

“A present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits.” -IFRS

Characteristics of a Liability

Common characteristics include:

- Those obligated to a liability are referred to as borrowers.

- Those owed debts by borrowers are referred to as creditors.

- Borrowers often intend to improve their personal or business situation when agreeing to a liability.

- Liabilities exist indefinitely unless the creditor or a court system states otherwise.

- Debt may be repaid over a short or long period of time and in a variety of ways generally agreed upon in advance by the borrower and the creditor.

Understanding Liabilities

Individuals, corporations, and governments may be the borrower in a transaction for a variety of reasons including:

- Individuals may need to borrow money to purchase a vehicle.

- Corporations may need to borrow money to expand their business.

- Governments may need to borrow money to build community centers.

Individuals, corporations, and governments may also be the creditor in a transaction for the following reasons:

- Individuals may loan money to a friend.

- Corporations may loan money to their customers.

- Governments may loan money to students for schooling.

Liabilities in Accounting

Accounting standards require that liabilities be reported in accordance with accepted accounting principles.

International Financial Reporting Standards (IFRS) is the most widely used accounting framework throughout the world.

Certain countries like the United States have adopted their own standard. The adopted U.S. framework is known as Generally Accepted Accounting Principles (GAAP).

Even though accounting standards may vary worldwide, most are principled in a similar fashion to IFRS which include:

- Liabilities classified as: current, non-current, or contingent.

- Balance sheets display liabilities according to the due date of the obligation.

- A consensus belief that improper management of liabilities may result in solvency issues or the need to file for bankruptcy to extinguish debt.

Types of Liabilities

Examples of liability types include:

Current Liabilities

Also known as near-term, current liabilities are obligations a business expects to pay within one year such as:

- Taxes: local, state, and federal income tax.

- Accounts payable: funds owed to vendors.

- Bonds: issued by the company and to be paid within the next 12 months.

- Wages payable: income employees have earned but have not yet received.

- Interest payable: interest due resulting from short-term purchases using company credit.

- Dividends payable: amounts owed to shareholders after dividend payments are declared.

Businesses routinely pay current liabilities during their standard day-to-day operations. The largest debts owed within this category tend to be accounts payable.

Accounts payable help maximize efficiency between businesses. For example, a bakery delivering goods to a coffee shop three times a week may choose to invoice the shop monthly instead of expecting payment during each delivery.

Monthly invoices help expedite deliveries and simplify the payment process. This common practice generally results in a large accounts payable liability.

Long-Term Liabilities

Also known as non-current, long-term liabilities are obligations a business expects to pay in 12 months or greater which include:

- Post employment benefits: obligations to retirees such as pension or healthcare benefits.

- Bonds: long-term bond payments issued by the business.

- Leases: long-term lease obligations often for equipment or commercial space.

- Notes payable: long-term business loans like installment notes issued by banks or other parties.

- Warranty liability: funds intended to cover overheard and repair involving product warranties.

- Contingent liability: a potential obligation that may arise from an uncertain event in the future.

The largest debts owed within this category tend to be bonds, often referred to as long term debt.

Large companies and governments often utilize bonds to acquire additional capital. They can help a business pay for large expansions and are issued as secured bonds or unsecured bonds.

For example, a manufacturing company with two owned warehouses may decide they need three owned warehouses to keep up with growing product demand. Therefore, the company issues bonds to help pay for the additional warehouse.

A summary of liability types can be found in the illustration below.

Liabilities Example

Balance sheets are formed utilizing Generally Accepted Accounting Principles (GAAP). These principles allow companies to list current and long-term liabilities in the order they prefer so long as they are categorized.

Liabilities and most assets show at cost on a balance sheet, not market value.

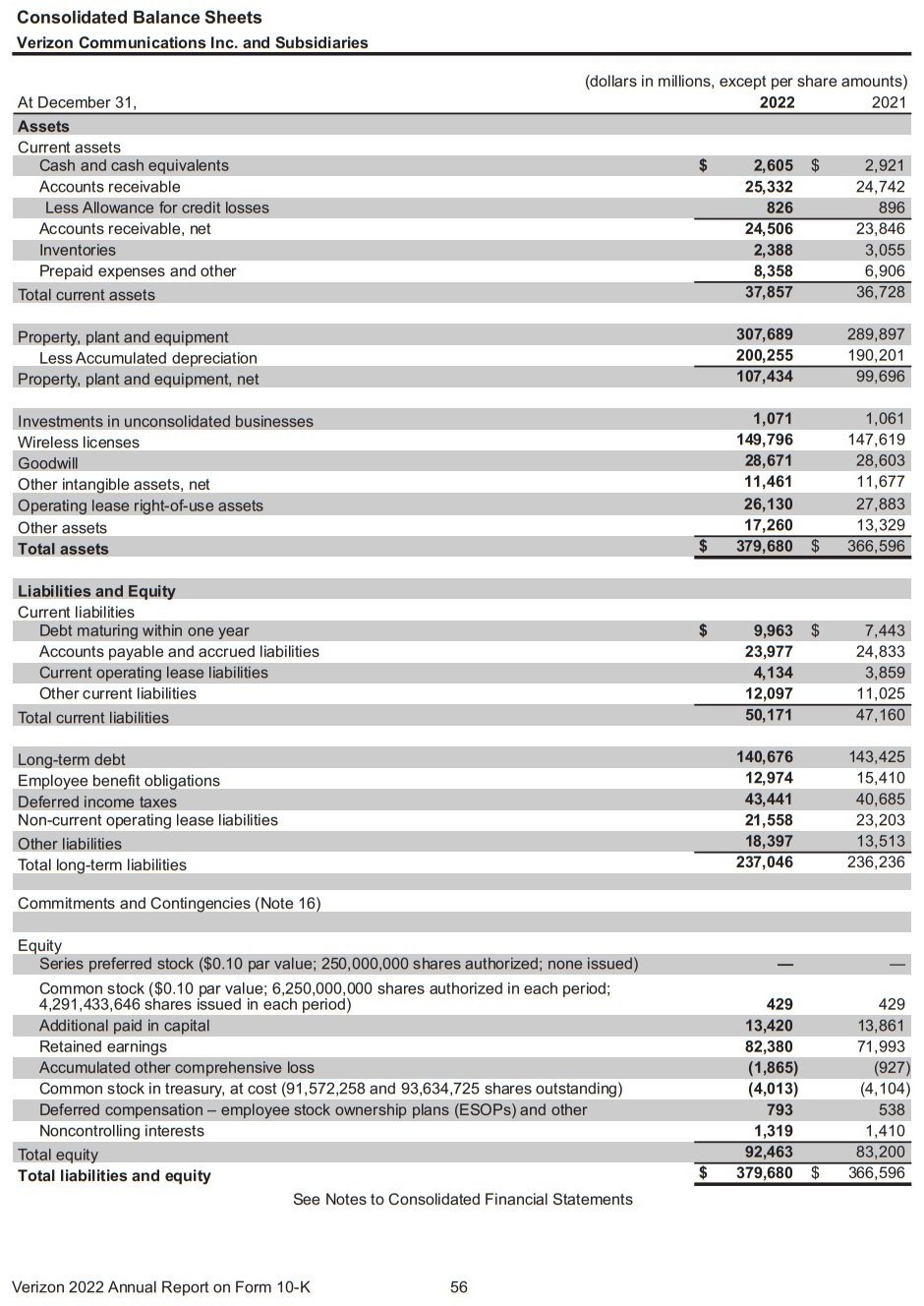

Below is Verizon, a telecommunication company’s balance sheet. The company’s liabilities are displayed in the middle half of the firm’s balance sheet.

Accounts payable is the firm’s largest current liability, which is often the case among most businesses. Accounts payable are essentially several bills awaiting payment that have not yet been settled.

Long-term debt is the company’s largest long-term liability which likely relates to financing company expansions. This debt category is often notably higher than other categories on the balance sheet of a larger sized company.

Key Ratios to Analyze Current Liabilities

A business’s liabilities can be examined in a variety of ways to determine its overall health and long-term viability.

Common key ratios used to analyze a business include:

- The cash ratio: cash and cash equivalents divided by current liabilities.

- The current ratio: current assets divided by current liabilities.

- The quick ratio: current assets, minus inventory, divided by current liabilities.

Assets vs. Liabilities vs. Equity

Assets, liabilities, and equity are reported on a balance sheet utilizing what is commonly referred to as The Accounting Equation.

The Accounting Equation is written as:

Assets = Liabilities + Equity

This formula mathematically relates assets, liabilities, and equity. There are other ways to rewrite the Accounting Equation, including:

Liabilities = Assets – Equity

Equity = Assets – Liabilities

Changes to any of the inputs mathematically affect all three components.

Debits and Credits

A concept known as double-entry bookkeeping also called double-entry accounting is the backbone of basic accounting.

It adheres to the following framework:

- Each transaction affects two different accounts.

- One account is debited, and one account is credited.

- Debits either increase an asset or decrease a liability.

- Credits either decrease an asset or increase a liability.

- The total of all debits must equal the total of all credits.

The purpose of double-entry is to:

- Standardize the practice of accounting.

- Increase financial statement correctness.

- Easily identify errors.

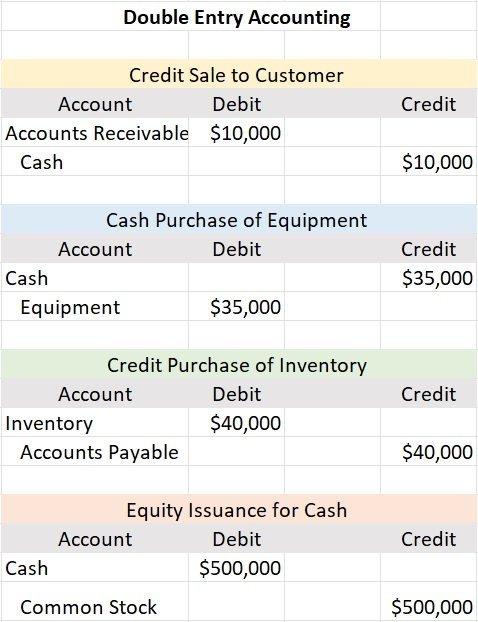

The below example illustrates four transactions and use of the double-entry method.

Liabilities vs. Expenses

Differences between liabilities and expenses include:

- Liabilities are listed on the balance sheet of a business.

- Expenses are listed on the income statement of a business.

- Liabilities are the debts of a business.

- Expenses are costs incurred during the operation of a business.

For example, a potato chip company generates $10,000,000 in revenue over a 12-month period. During the production cycle, the company would likely incur and pay the following expenses:

- Utilities

- Supplies

- Materials

- Maintenance

These expenses are not considered liabilities since they represent obligations that have already been met.

A common practice is to pay expenses in cash over a short period of time since otherwise the owed amount would become a liability.

Identifying a Liability

The terms borrowed, owed, or obligated are good indications that a liability relationship exists among individuals, companies, or governments.

A liability may be in the present such as owing a monthly automobile payment, or it may be in the future.

Liabilities may be referred to as negative or positive depending on context.

Companies often borrow funds when expanding a business which could result in new hires and revenue growth. The borrowing of funds to expand the business may be viewed as a positive liability.

Years later, those hired employees could be laid off due to a slowing economy. At that time, too many employees may be viewed as a negative liability from a contextual standpoint.

Current Liabilities vs. Long-Term

Businesses separate current and long-term liabilities based on due dates which help maximize cash flow efficiencies.

It is common practice for current assets to be used to pay current liabilities due within the next 12 months. Therefore, understanding and anticipating this dynamic helps businesses ensure order and timely payments to:

- Vendors

- Employees

- Tax authorities

- Other short-term obligations

Long-term liabilities also known as non-current are due in 12 months or longer and allow a business to form long-term repayment strategies for costs involving:

- Post-employment benefits

- Bonds

- Notes payable

- Other lengthy obligations

What is a Contingent Liability?

Contingent liabilities also known as potential liabilities commonly include:

- Warranties

- Lawsuits

- Governmental policy changes

These costs could arise in the future based on the outcome of an event which a company may have minimal control over. Companies may plan for these expenses if they anticipate an outcome requiring them to do so.

Common Liabilities of Individuals

Common debt obligations of an individual may include:

- Rent or mortgage

- Taxes

- Automobile loan

- Student loan

Taxes and rent or mortgage payments are often the largest liability of an individual or household.

An individual’s financial net worth can be viewed similarly to equity in a business:

Assets – Liabilities = Net Worth (individual)

Assets – Liabilities = Equity (business)

Both individuals and businesses benefit when maximizing assets and minimizing liabilities.

Are Liabilities Good to Have?

Debt obligations are common among individuals, companies, and governments. Generally, the degree to which liabilities are used often determines their quality.

Additional factors often considered when making such a determination may include:

- Debts vs income

- Debts vs equity

- Debts vs net worth (individual)

If an individual, company, or government’s annual debts exceed their annual income, one may conclude liabilities are “not good” in that instance.

On the other hand, if annual debts were 20% of annual income, one may believe liabilities to be helpful in growing individual wealth or business revenues.

Other Definitions of a Liability

The term liability can be used in many ways relating to a state of being responsible such as:

- An individual or business may be liable for damages in a civil lawsuit.

- A property owner may have a tax liability involving property taxes owed.

- The business that partners with a football star may view the athlete as a liability if they are convicted of a serious crime.

A person or business can also be held liable from a legal standpoint; therefore, liability insurance is frequently purchased as a form of financial protection.

What is Liability Insurance?

There are several types of liability insurance policies an individual or business may obtain. Furthermore, these policies are intended to help protect financial interests should a third party raise legal allegations of wrongdoing.

Common types of individual liability insurance include:

- Property damage liability insurance.

- Personal liability insurance.

- Bodily injury liability insurance.

Common types of business liability insurance include:

- General liability insurance.

- Professional liability insurance.

- Commercial umbrella liability insurance.

It is a common business practice to have this type of insurance in place to protect a business from legal claims should they arise. Policies offer businesses owners peace of mind regarding unexpected financial risk. Furthermore, liability insurance premiums regularly appear on a business’s financial statements.