What are Financial Statements?

Financial statements are official written records outlining the business and financial activities of an individual, company, or other entity.

Statements are commonly audited by various parties such as governments or accounting firms to ensure completeness and accuracy.

Purpose and Types of Financial Statements

Data within financial statements supply creditors, analysts, investors, and other interested parties with detailed financial information about a company.

A company’s annual report includes audited data along with three common financial statements:

- The Balance Sheet

- The Income Statement

- The Statement of Cash Flows

These documents provide key insights into a company including a detailed snapshot of company finances.

Interested third parties can use this data to:

- Analyze a company’s current financial strength.

- Forecast future performance and stock price.

- Owners, managers, and investors can make decisions based on data.

- Financial institutions can grant or not grant loans.

The Balance Sheet

Balance sheets outline a company’s: assets, liabilities, and shareholders’ equity. This information is supplied as to a specific date listed on the balance sheet, commonly the last day of a reporting period.

Balance sheets include the following details:

Assets Section

- Cash & cash equivalents are deposit accounts, currency, and negotiable instruments.

- Accounts receivable are funds due but not yet collected for goods and services provided.

- Inventories are goods and products as well as raw materials.

- Prepaid expenses are future expenses paid in advance such as insurance and rent.

- Property, plant, and equipment are long-term assets such as buildings, equipment, and machinery.

- Investments are long-term speculative financial assets such as stocks, sovereign or corporate bonds, and preferred equity.

- Intangible Resources are other assets that offer long-term economic value such as copyrights, trademarks, and patents.

Liabilities Section

- Accounts payable are funds owed to vendors.

- Wages payable are income employees have earned but not yet received.

- Notes payable are long-term business loans such as installment notes issued by banks or other parties.

- Dividends payable are amounts owed to shareholders after dividend payments are declared.

- Long-term debt is debt that is due in greater than twelve months such as post-employment benefits, bonds, leases, etc.

Shareholders’ Equity

Shareholders’ equity, also known as stockholders’ equity, is the difference between a company’s total assets and total liabilities. It represents the remaining value to be distributed to shareholders if all assets were liquidated and all debts paid or fully extinguished.

It can be written as:

Shareholders’ Equity = Total Assets – Total Liabilities

Retained earnings are a percentage of shareholders’ equity. They represent net earnings not paid to shareholders as dividends.

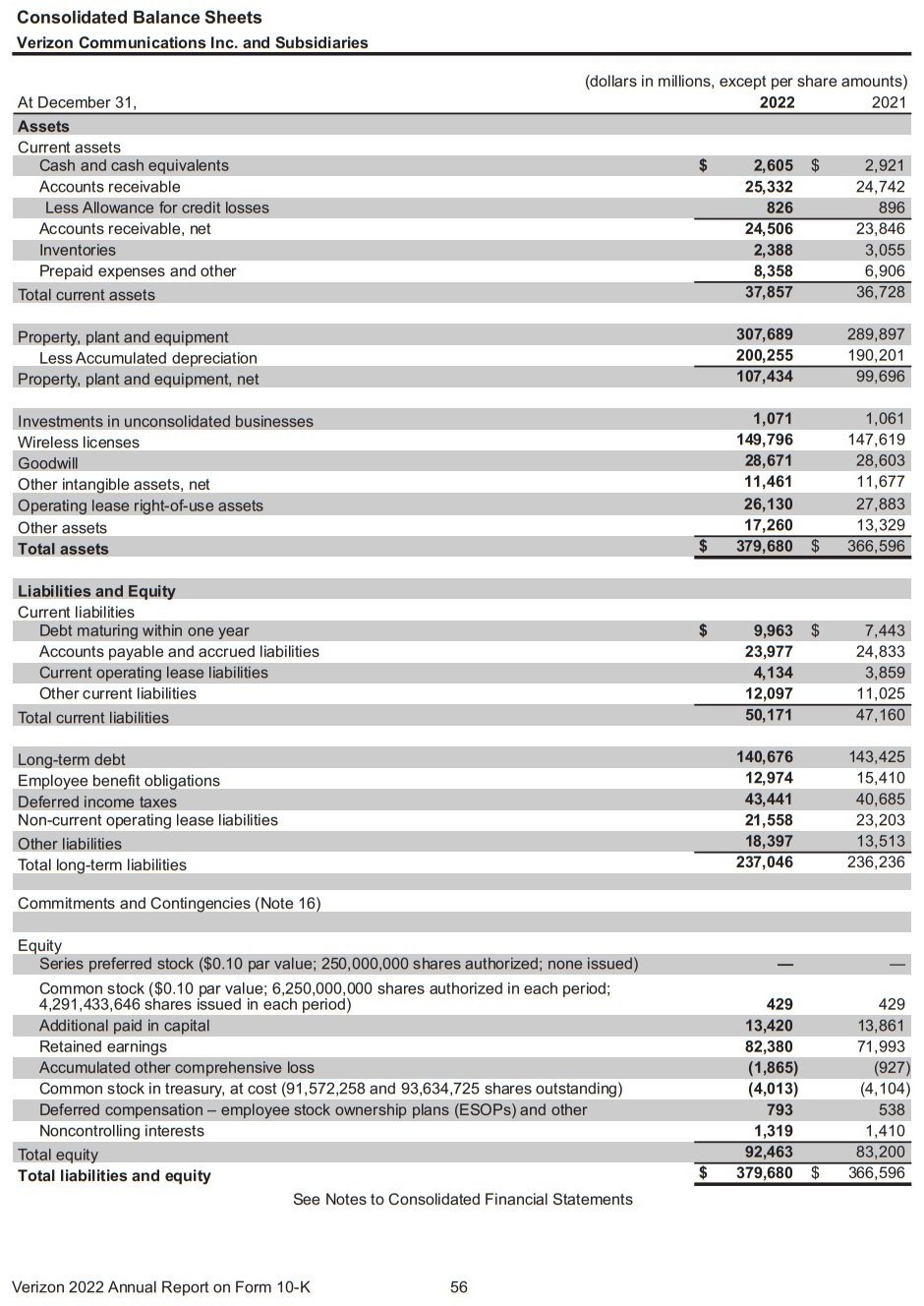

Sample Balance Sheet

The balance sheet for Verizon (VZ), a telecommunications company for calendar years ending 2022 and 2021 is below.

The following key areas are noted as of Dec 31st, 2022:

- Total assets were $379.6 billion.

- Total liabilities were $287.2 billion. This is factored by adding “total current liabilities” + “total long-term liabilities.”

- Total equity was $92.4 billion.

- Total liabilities and equity were $379.6 billion, which matches total assets for the year.

The Income Statement

Income statements outline a company’s revenues, expenses, net income, and earnings per share for a given period. The most common reporting periods are quarterly and annually.

Statements often include several previous periods for comparison such as:

- Three Months: October to December 2022 vs October to December 2021

- Six Months: January to June 2022 vs January to June 2021

- Annually: 2022 vs 2021

Income statements help creditors, analysts, investors, and other third parties better understand a business’s ability to generate profits.

Revenue Section

Income statements begin with operating revenue which is generated from the sale of products or services.

For example, a window repair company would generate operating revenues from the sale of products and the servicing of existing windows. This revenue type originates from core business activities.

Companies also generate non-operating revenues also known as non-core business activities.

The window repair company’s non-operating revenues may include:

- Income from business partnerships.

- Interest on cash.

- Income from third-party advertisements on the company website.

Income statements may also include a section labeled “other income”.

For the window repair company, this may involve the sale of long-term assets such as:

- Vehicles

- Equipment

- A building

Expenses Section

Expenses are broken down into primary and secondary expense types.

Primary expenses occur while earning revenue from primary business activities. For example, a window repair company would incur primary expenses while engaging in core business activities such as selling products and repairing windows.

Common primary expenses include:

- Cost of goods sold (COGS).

- Selling, general & administrative (SG&A).

- Depreciation and amortization.

Secondary expenses occur while engaging in non-core business activities such as:

- Paying interest on debts.

- Selling assets at a loss.

The expense section of an income statement helps investors better understand company costs in relation to revenues.

It also demonstrates trends when comparing data to previous periods such as:

- Are total revenues increasing or decreasing?

- Are total expenses increasing or decreasing?

Sample Income Statement

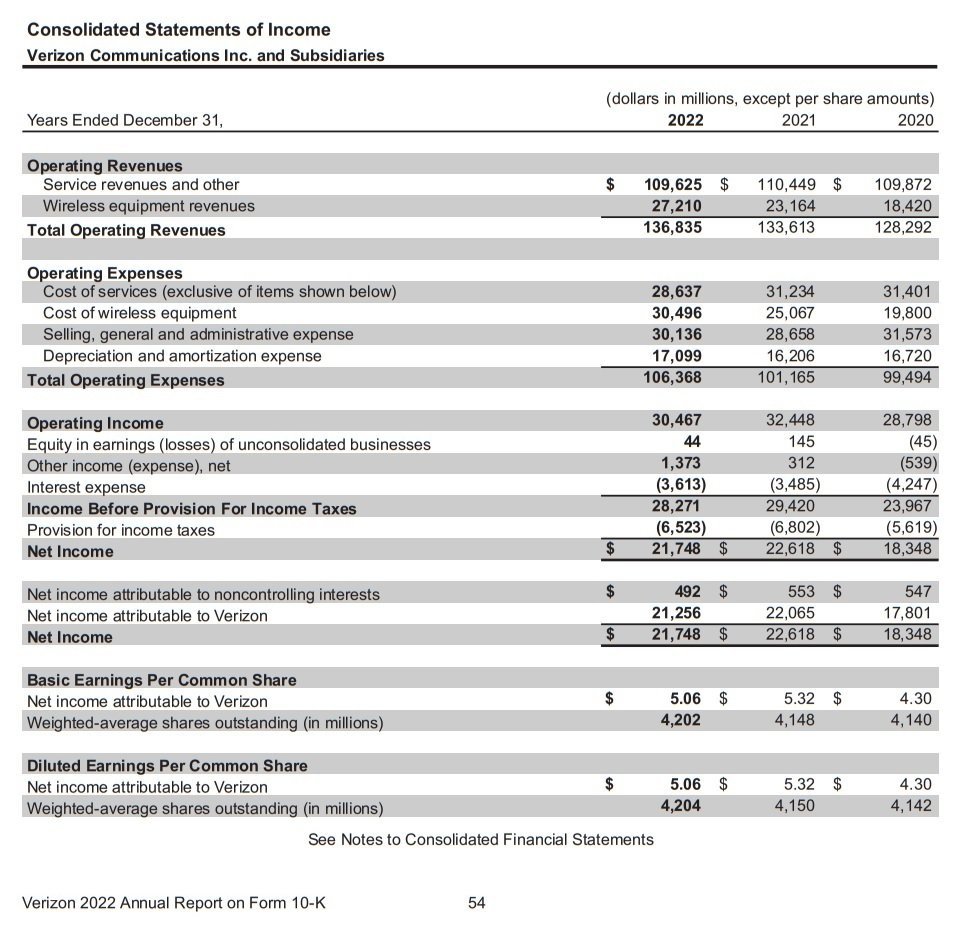

The income statement for Verizon (VZ), a telecommunications company for calendar years ending 2022 and 2021 is below.

The following key areas are noted as of Dec 31st, 2022:

- Total revenue was $136.8 billion.

- Total costs were $106.3 billion.

- Net income was $21.7 billion.

The Statement of Cash Flows

The statement of cash flows helps reconcile the income statement with the balance sheet. It also demonstrates a business’s effectiveness in generating and allocating cash.

Investors can review in greater detail:

- Where money originates within the business.

- How money cycles through the business.

Having a strong understanding of a company’s cash flows helps investors better understand its strengths and weaknesses.

Operating Activities Section

Most of a business’s cash flows exist within the operating activities section of a cash flow statement.

Inflows of cash from selling products and services cover the day-to-day operational costs of running a business and result in accounting changes most notably:

- Inventory

- Accounts receivable

- Accounts payable

- Rent

- Wages

- Income Tax

- Interest Payments

- Depreciation

Investing Activities Section

Investing activities are often long-term focused transactions.

They often include:

- Property, plant, equipment (PPE)

- Investment instruments

- Mergers and acquisitions

Although these activities are less common than operational activities, they give investors insight into the direction of a company.

Financing Activities Section

Financing activities primarily include the financial relationships a company has with its investors and creditors.

Common financing activities include:

- Dividend payments

- Stock repurchases

- Equity issuance

- Adding, changing, or retiring of loans

These activities demonstrate to investors how a company funds the ongoing operations of its business.

Sample Statement of Cash Flows

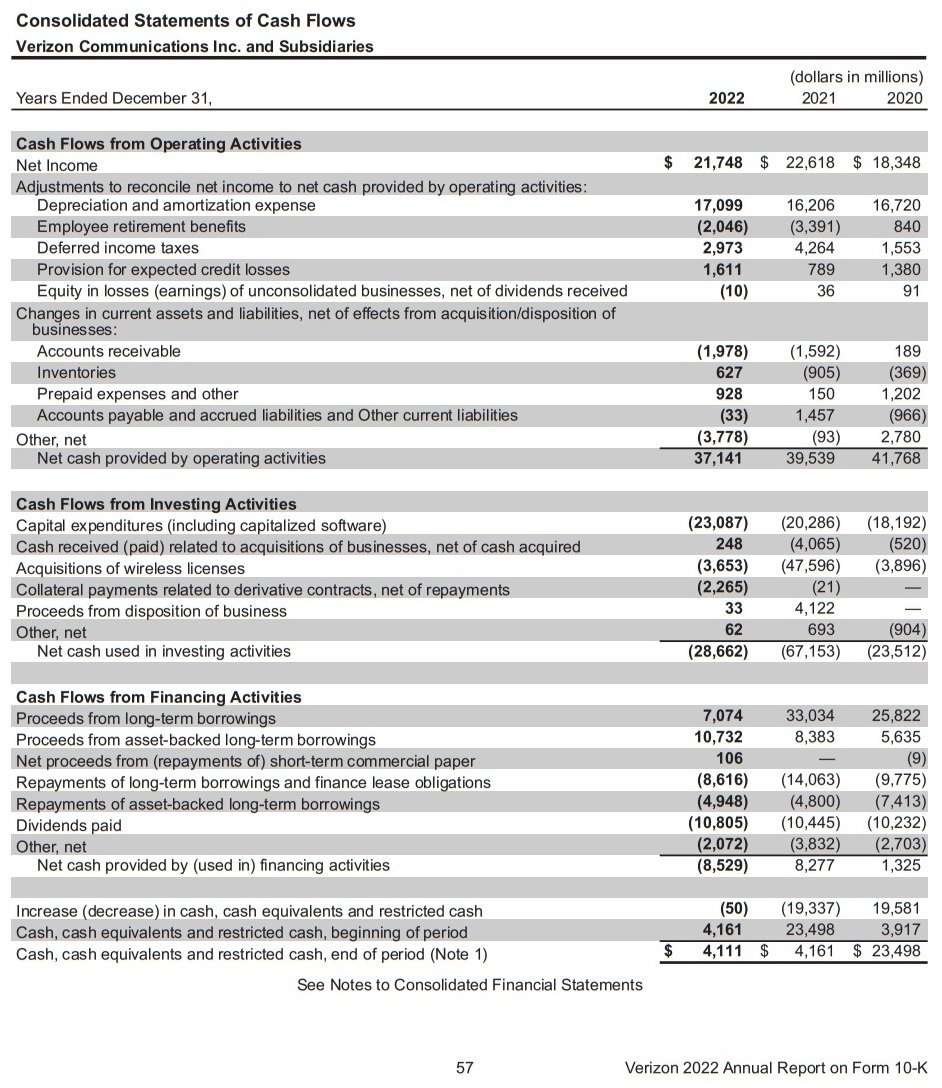

The statement of cash flows for Verizon (VZ), a telecommunications company for calendar years ending 2022 and 2021 is below.

The following key areas are noted as of Dec 31st, 2022:

- Operating activities show positive cash flows of $37.1 billion for the year.

- Investing activities show negative cash outflows of $28.6 billion. Most of the outflow relates to new fixed asset investments also called capital expenditures or property, plant, and equipment (PPE).

- Financing activities show negative cash outflows of $8.5 billion for the year. Dividends paid out and reducing long-term debt were the larger portions of cash outflows.

The Statement of Changes in Shareholder Equity

The statement of changes in shareholder equity is often included within a company’s annual financial statements. It is not typically included during monthly or quarterly financial statement issuances.

This statement documents beginning and ending equity balances of a company during a given reporting period using the following calculation:

Ending equity = Beginning equity + Net income – Dividends +/- Other changes

This formula may vary slightly from business to business.

The ending equity balance on the statement of changes in shareholder equity will match total equity on the balance sheet for the same reporting period after the below adjustments:

- Beginning equity starts with equity figure from the end of the last reporting period.

- (+) Net income includes income earned during the given period. Operational proceeds are acknowledged as equity and included in retained earnings at year-end.

- (-) Dividends include shareholder profit payouts the company elected to pay out to shareholders instead of retaining as company profit.

- (+/-) Other comprehensive income includes changes in other comprehensive income during the period which may be positive or negative.

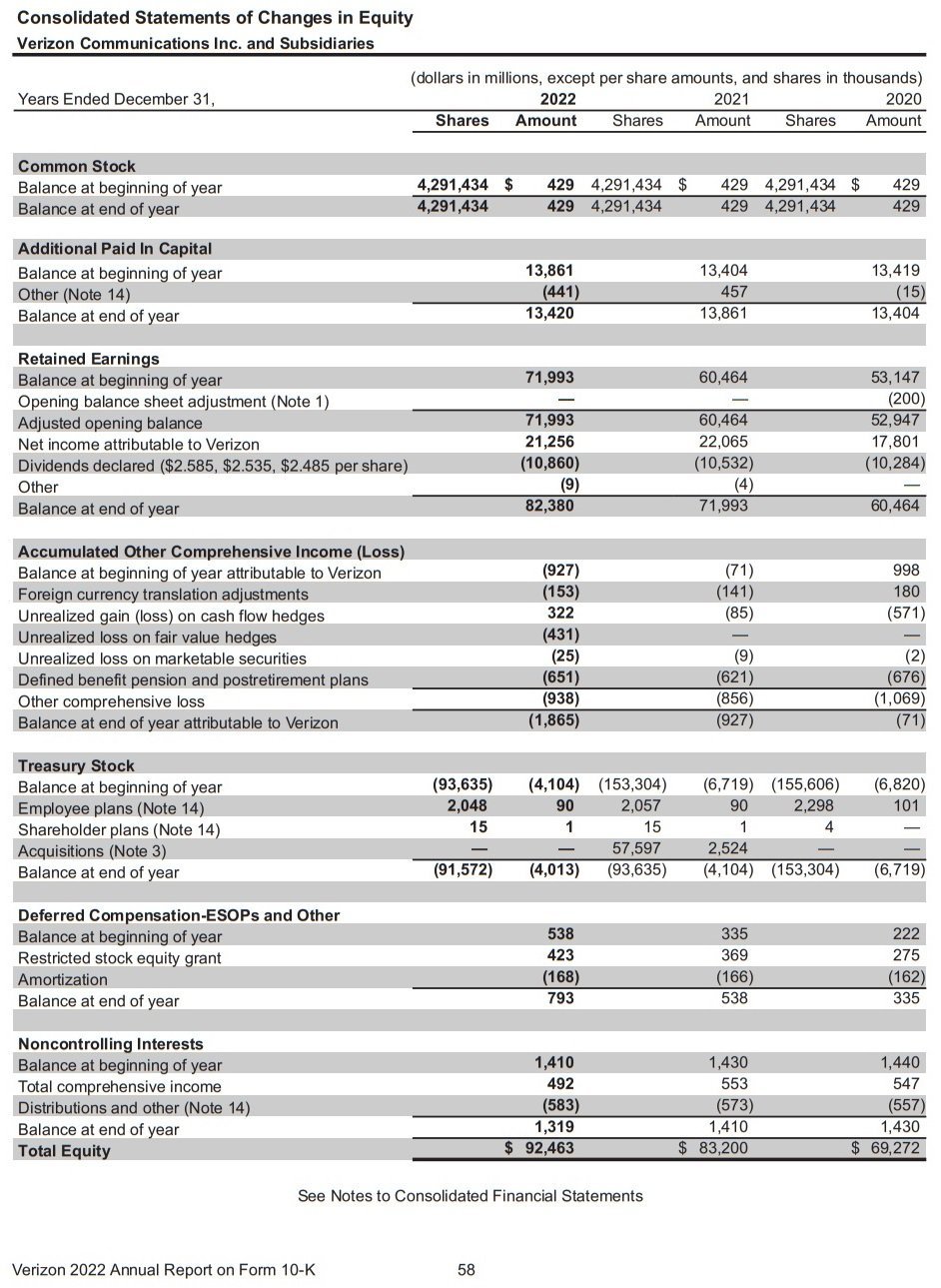

As can be seen below, Verizon also records additional transactions such as acquisitions, amortization, and other financial activity. This additional data helps readers better understand how much money is being retained for future growth.

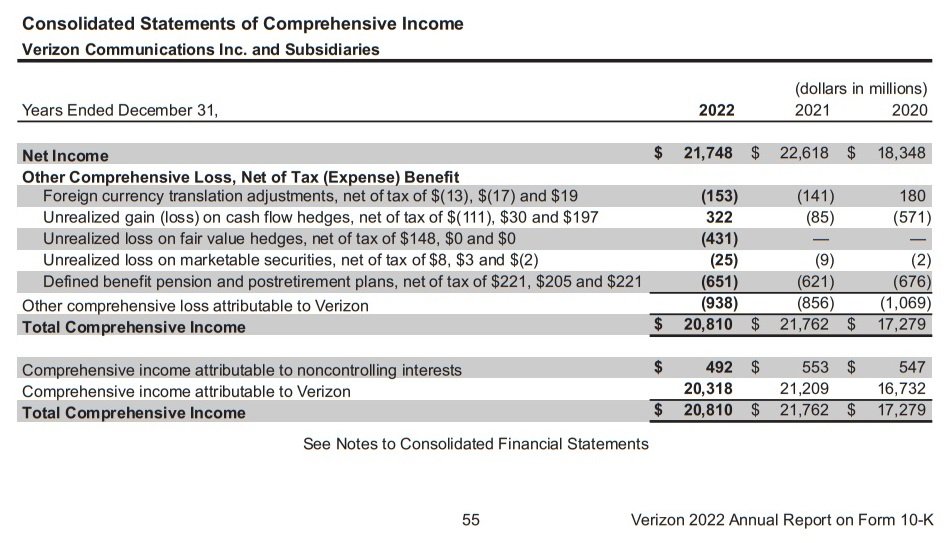

The Statement of Comprehensive Income

The statement of comprehensive income is considered an extension of the income statement.

It details revenue and expense items that have not yet been realized utilizing the following formula:

Total Comprehensive Income = Net income +/- Unrealized gains or losses

The statement supplies a deeper look into a company’s financials. Not all businesses engage in transactions appearing on a statement of comprehensive income, especially smaller companies.

For those that do, common transactions include:

- Net income from the statement of income.

- (+/-) Unrealized gains or losses from foreign currency adjustments.

- (+/-) Unrealized gains or losses from marketable securities.

- (+/-) Unrealized gains or losses from retirement plans.

As can be seen below, Verizon has almost $1 billion of net unrealized losses. Instead of reporting $21.7 billion of net income, they report $20.8 billion of total income when including other comprehensive income.

Financial Statements of Nonprofits

Nonprofit entities utilize financial statements in a similar manner as for-profit companies. Differences do exist due to the differing structure of a non-profit organization.

Non-Profit financial statements include:

The Statement of Financial Position closely resembles the balance sheet of a for-profit company. The main difference being non-profits do not have equity positions. Therefore, the equity section of a balance sheet becomes the net assets section. Non-Profits use the net assets section to identify:

- Net assets with donor restrictions.

- Net assets without donor restrictions.

The Statement of Activities closely resembles a for-profit company’s statement of income. It identifies revenue from grants, donations, etc. as well as expenses during a specified period. These activities are classified as:

- With donor restrictions.

- Without donor restrictions.

The Statement of Functional Expenses is specifically used for non-profit entities. It outlines expenses based on each functional area of the organization which may include:

- Fund raising

- Programs

- Administration

The Statement of Cash Flows closely follows the same format as a for-profit company although non-profit transaction types may differ. The document similarly categorizes sections into operating, investing, and financing activities while demonstrating how the non-profit manages its cash.

What are Consolidated Financial Statements?

Consolidated financial statements are formally defined as:

“Financial statements that present the assets, liabilities, equity, income, expenses, and cash flows of a parent and its subsidiaries as those of a single economic entity” -IFRS

Therefore, consolidated financial statements supply an overview of a business that controls other businesses.

For example, XYZ company may own and operate a gas station business with 125 locations. The company may also own and operate a car washing business with 50 locations. In addition, it may have recently purchased a drive-through oil change business with 80 locations.

XYZ company may run each line of business as a separate entity, often referred to as a subsidiary. Each subsidiary would have its own set of financial statements.

A consolidated financial statement would combine the finances of the gas station business, the car wash business, and the oil change business while presenting them as one single business.

Limitations and Disadvantages of Financial Statements

Although financial statements offer several benefits, limitations and disadvantages should be considered such as:

Open to Interpretation: Investors may interpret or make assumptions after reviewing financial statements that may or may not be true. For example, if a company has experienced year over year growth the past three years, an investor may assume growth will continue into the fourth year which may not transpire as expected.

In addition, one investor may view a new acquisition as positive while another investor may view it as a negative course of action for the business.

Inaccurate or Misleading Financial Reporting: Users of financial statements generally trust supplied data accurately reflecting a company’s current financial state. However, financial statements may include inaccurate or misleading data due to poor oversight or willful negligence. As a result, companies may receive loans or investor funds they otherwise would not have received.

Reviewers of financial statements should consider these and other risks surrounding financial statement preparation and presentation.

Benefits and Advantages of Financial Statements

Financial statements offer reviewers a variety of benefits and advantages including the following:

- How a company generates its revenues.

- What types of costs exist throughout the course of business.

- How a company manages its cash flows.

- What assets a company owns.

- What liabilities a company is obligated to satisfy.

- If a company has the resources to pay its debts.

Financial statements also allow the reader to trend out company results over time as well as analyze financial ratios to determine the health and potential direction of a business.

Investors and other third parties can formulate positive or negative viewpoints of a company based on the data within financial statements.

Financial Ratios and Calculations

Data within financial statements provide investors with the necessary information to calculate and analyze a company’s financial ratios. Furthermore, these ratios help determine the financial health and potential direction of a company.

Some ratios are considered more important than others depending on the industry in which a business operates. They can be analyzed in a variety of ways.

Common ratios used to analyze a business include:

P/E Ratio: calculated as price per share divided by earnings per share.

For example, if company stock sells for $30 per share while the company earns $5 per share:

$30 / $5 = 6

Company stock sells for 6 times its earnings.

Operating Margin: calculated as income from operations divided by net revenues.

For example, if a business generated $1,000,000 of income from operations over a 12-month period and had net revenues of $100,000:

$1,000,000 / $100,000 = 10

For each dollar of sales, 10 percent is profit.

Debt to Equity: calculated as total liabilities divided by shareholder equity.

For example, if a business has $2,000,000 in total liabilities and has $1,000,000 in shareholder equity:

$2,000,000 / $1,000,000 = 2

The business has a debt-to-equity ratio of 2, meaning two dollars of debt exist for every one dollar invested in the company by shareholders.

Standards and Regulation of Financial Statements

Income statements and balance sheets are considered standard and necessary financial reporting tools of public or private entities. Various accounting principles exist worldwide outlining how financial statements are to be created and presented based on target audience.

Statements issued internally within a firm are not required to follow any specific format. However, statements issued within government agencies often follow their own preferred format which varies from public to non-profit entities. Furthermore, government agencies may use accrual or cost accounting methods, sometimes a combination of both.

When issuing statements outside a publicly owned company, a major accounting framework is often required. Different countries utilize different accounting frameworks which make outside country comparisons difficult.

Although accounting standards vary throughout the world, most are principled in International Financial Reporting Standards (IFRS) which is the most commonly used standard throughout the world.

Other countries like the United States have adopted their own reporting standard known as Generally Accepted Accounting Principles (GAAP).

What is GAAP?

Generally Accepted Accounting Principles (GAAP) is the recognized accounting standard within the United States. Public companies must follow GAAP guidelines which are issued by the Financial Accounting Standards Board (FASB) and overseen by the U.S. Securities and Exchange Commission (SEC).

GAAP is dictated by ten key topics which outline required procedures, rules, and standards such as:

- When to recognize revenue.

- How to record transactions.

- When to recognize expenses.

- How to classify balance sheet entries.

The primary goals of GAAP are to ensure accuracy, reliability, and consistency exist within a public firm’s financial statements. Therefore, investors and other stakeholders can more easily analyze and interpret financial statement data with a clear trustworthy framework in place.

Auditing and Legal Ramifications of Financial Statements

Audited financial statements are often required throughout the course of business for taxation, financing, and investment purposes. It is common practice and often a legal requirement for public companies to audit their financial statements. Therefore, an external auditing firm or independent accountant reviews the firm’s statements and provides an audit report outlining their findings.

The process may or may not include a field auditor with multiple on-site visits along with the vouching of data to ensure reporting accuracy. Nonetheless, audit reports offer an unqualified opinion as to the firm’s financial statements or qualifications as to their fairness and accuracy, which is commonly supplied within annual reports.

Auditor liability has been an ongoing legal debate worldwide. Audit reports commonly address current shareholders, which indicates a responsibility towards that group. Although, many countries’ laws contradict that viewpoint.

Some countries state:

- Auditors are liable to investors buying shares in the open market using a prospectus to make investment decisions OR

- Auditors are liable to potential investors using financial statements to make investment decisions OR

- Auditors have unlimited liability.

Auditors commonly include language within reports restricting liability to only those addressed within the report.

Countries deeply concerned with fairness and accuracy of financial reporting such as the United States require Chief Executive Officers (CEO) and Chief Financial Officers (CFO) certify quarterly and annual reports.

Management Discussion and Analysis (MD&A)

Management discussion and analysis (MD&A) is a summary of past, present, and future business activities. The statement is not audited and commonly supplied by upper management during the issuance of a company’s annual financial statements.

Discussing the state of a business through the eyes of management is intended to provide stakeholders with a clear understanding as to the business’s current and future direction. Therefore, management typically narrates the past year and outlines key decisions and reasoning behind such actions.

Topics of discussion commonly include:

- Operational results

- Available liquidity

- Current trends

The MD&A is generally intended to build confidence among the investor community by outlining why a company will continue to be successful.

It also helps investors better understand narratives behind financial statement data.

Notes throughout Financial Statements

Financial statements include notes throughout the text which are also referred to as “footnotes” or “notes to consolidated financial statements”. Notes supply additional narrative data and are intended to clarify and provide context beyond numerical data.

Common topics include:

Income Tax: breaks down details surrounding current and deferred income tax at the foreign, federal, state, and local levels. Thereby, items largely influencing a company’s effective tax rate are identified and discussed.

Pension and Retirement Plans: discusses pension and other retirement obligations and their associated costs. Assets and costs are typically broken down along with identifying over or underfunded status.

Stock Options: identifies any stock-based compensation and accounting methods used to track allocations to employees or officers. Granted shares are commonly outlined in detail.

Accounting Policies: outlines accounting policies and practices a company adheres to and most closely identifies with. Management therefore elects such policies and practices that best demonstrate the company’s financial results.

How to Read Financial Statements

Financial statements can be read and interpreted in a variety of ways. Statements are commonly used to compare prior periods of performance. Therefore, prior quarters or prior years are often listed as a reference point. Readers can then easily identify trends such as increasing or decreasing revenues when analyzing financial statement data. Furthermore, trends help the reader better understand the financial health of a company.

Financial statements also allow investors the ability to compare a company against its competitors and industry benchmarks. When comparing, investors can see which companies are growing revenues the fastest and which companies are best controlling costs.

Personal Financial Statements

Personal financial statements (PFS) are sometimes required when individuals apply for a personal loan, business loan, or financial aid. The document has similar characteristics to a balance sheet or income statement of a business. Furthermore, required items are determined by the entity requesting the personal financial statement. An individual commonly lists assets, liabilities, income, and expenses on the document.

Collected data would then be used when determining loan/program eligibility.