What is an Installment Note?

An installment note is an agreement between a borrower and a lender that outlines terms in which money is owed.

“To pay a certain amount of money to a named party, or to deposit money as such persons direct.” -Cornell Law School

Understanding

An installment note is a form of debt instrument also known as a promissory note. It is a liability for a borrower and an asset for the person or company loaning funds.

In most cases, installment notes are used between two people, a person and a company, or between two companies. Furthermore, they are often viewed as a substitute in lieu of bank financing and considered legal documents meant to protect borrower and lender interests.

Borrowers typically agree to repay loaned funds over a predetermined time at a set rate of interest. The repayment period could be days, weeks, months, or years; however long is necessary to fully repay the principal amount plus interest.

Both the borrower and lender mutually agree upon specifics of the transaction before the borrower signs an agreement outlining the terms.

In some jurisdictions, finance regulations may require specific verbiage be included within the document outlining a borrower’s intended purpose for the loaned funds such as purchase a home, car, or to finance business related property. The note may also include verbiage outlining options available to the lender should the borrower not make payments as agreed. In addition, the term “loan default” is commonly used to describe this situation.

With installment notes being considered legal documents, a lender may elect to pursue action via the local court system to collect outstanding funds should a loan default occur. This legal process varies based on jurisdiction.

A balloon loan or lump sum note are similar agreements however they commonly require repayment on a specific date. Furthermore, they don’t allow for a payment plan as would installment notes.

Installment notes are said to be “paid in full” once they no longer exist unless settled with the creditor under another form of debt extinguishment which may involve a negotiated settlement.

How an Installment Note is Reported in Business

An installment note would show within a business’s financial statements, more specifically under the liabilities section of the balance sheet. This type of obligation is commonly known as “notes payable” and is often a long-term debt.

From an accounting perspective, if a business owner took out a 10-year $200,000 installment note from a bank, they’d record the note as a debit to cash and a credit to notes payable. Each payment is often referred to as a partial payment of the total amount owed.

What May an Installment Note Include?

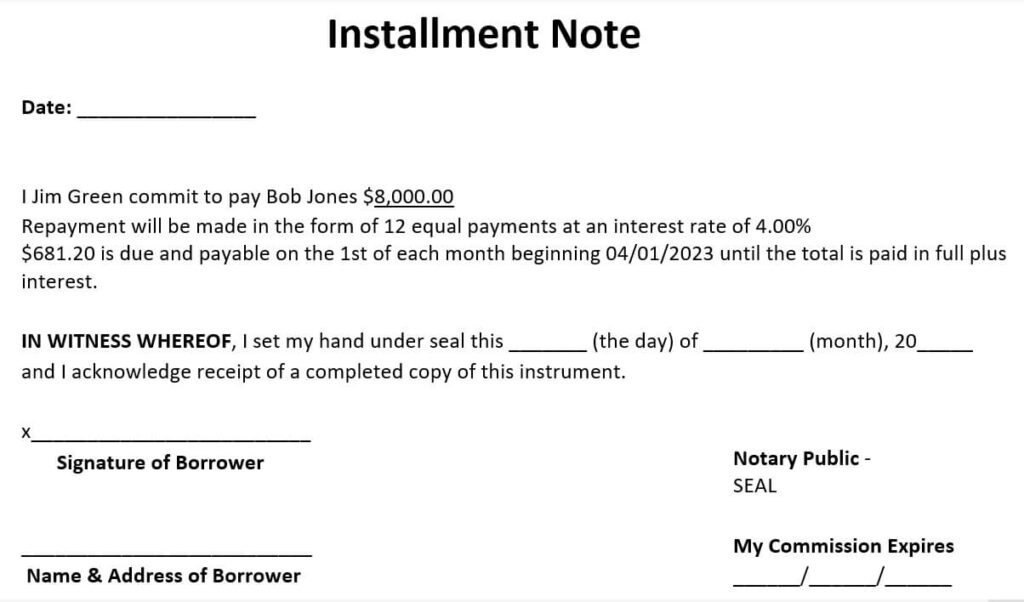

Installment notes typically include details such as how interest is applied when payments are made by the borrower. In addition, these details could identify the note including a fixed rate or a floating rate of interest. Installment notes commonly include the following as well:

- Date of agreement.

- Name of borrower.

- Name of lender.

- Amount of money loaned.

- Interest rate on the loan.

- Repayment period for the loan.

- Amount of each payment.

- Signature of borrower.

- Location in which transaction transpired.

Example

Bob Jones decides to sell his used car to the next-door neighbor Jim Green. They agree on a price of $10,000. Jim advises Bob he has $2,000 cash and asks Bob if he can pay the remaining $8,000 owed monthly over a 1-year period at a 4.00% fixed rate of interest. Bob agrees. They draft up an installment note covering the agreement which Jim signs.

Installment Note Example