What is an Asset?

An asset is a resource that provides current or future economic benefit owned or controlled by an individual, corporation, or government.

Definitions from regulatory boards include:

“A present economic resource controlled by the entity as a result of past events.” -IFRS

“A present right of an entity to an economic benefit.” -FASB

Understanding an Asset

An asset’s owner or controller is the recipient of its outcomes. Assets can be owned or controlled by individuals, corporations, and governments. They are purchased, created, and held for an expected future benefit.

These benefits may include:

- Creation of cash flow.

- Reduction in expenses.

- Improvement in sales.

Characteristics of an Asset

An asset possesses the following three characteristics:

Resource: They are often referred to as resources, which offer current or future economic benefits.

Ownership: They demonstrate ownership, which can be converted into cash or other asset types.

Economic Value: They offer economic value, which can be sold or exchanged.

Tangible vs Intangible Assets

An organization’s financial statements include both tangible and intangible assets. Tangible assets have a physical form and can be valued. Furthermore, intangible assets have no physical form and can be more difficult to value. Each are valuable to a business.

Examples of both include:

Tangible

- Gold and silver.

- A residential home.

- Collectible Artwork.

Intangible

- Patents issued to a drug manufacturer.

- Copyrights owned by a company.

- Operational licenses and permits issued to a gold mining company.

Asset Types and Examples

Basic accounting principles often classify an asset based on several qualities including:

Convertibility: How easily the owner can convert the asset into cash.

Usability: How the asset is being used, and it’s intended purpose.

Physical Existence: How the asset exists, and if it is tangible or intangible.

Various types include:

Current Assets

Also known as liquid assets, current assets are resources a business expects to convert into cash and utilize within one year such as:

- Cash & cash equivalents: currency, deposit accounts, or negotiable instruments.

- Prepaid expenses: future expenses paid in advance such as insurance and rent.

- Investments: short-term securities held to generate income.

- Accounts receivable: funds due but not yet collected for goods & services provided.

- Inventory: goods or products, and sometimes raw materials.

A business continuously absorbs current assets throughout its day-to-day operations. Accounts receivable and inventory are routinely analyzed. Therefore, if there is evidence of collectability issues or obsolescence, a business could decrease the value of these asset types. Ongoing reviews ensure accurate reporting of these asset types.

Fixed Assets

Also known as non-current assets, fixed assets are resources a business cannot easily convert into cash & cash equivalents. They are also referred to as hard assets or PP&E (property, plant, and equipment). Fixed assets are expected to exist longer than a year and include:

- Land

- Buildings

- Equipment

- Machinery

Businesses purchase these asset types for long-term use to help generate profits. Furthermore, they benefit from an accounting practice known as depreciation. As the assets age, depreciation dictates how to expense the items from an accounting perspective.

Generally Accepted Accounting Principles (GAAP) outline various ways expensing can be applied which includes:

Straight Line Method: Fixed assets lose value based on their useful life.

Accelerated Method: Fixed assets lose value fastest during the first few years of use.

Businesses can determine and select whichever method they deem most optimal for the organization. Or, they may choose to utilize both methods.

Financial Assets

Financial assets are investments in other companies or government entities, also known as long-term investments which include:

- Stocks

- Sovereign or corporate bonds

- Preferred equity

- Other hybrid securities

These assets are held for many years and are unlikely to be liquidated in a short period of time. In addition, their value is affected by the entity they are linked to as well as supply and demand within that market. Therefore, value can fluctuate over time.

Intangible Assets

This asset type does not have any physical properties and can be hard to evaluate such as:

- Copyrights

- Trademarks

- Patents

- Franchises

- Licenses & permits

Intangible assets often exist due to contractual or legal rights.

This asset type benefits from an accounting practice known as amortization. As an item ages, amortization allows its cost to be spread out over its useful life according to Generally Accepted Accounting Principles (GAAP).

Furthermore, useful life can be amortized from 5 to 40 years. Businesses have flexibility when making such determinations.

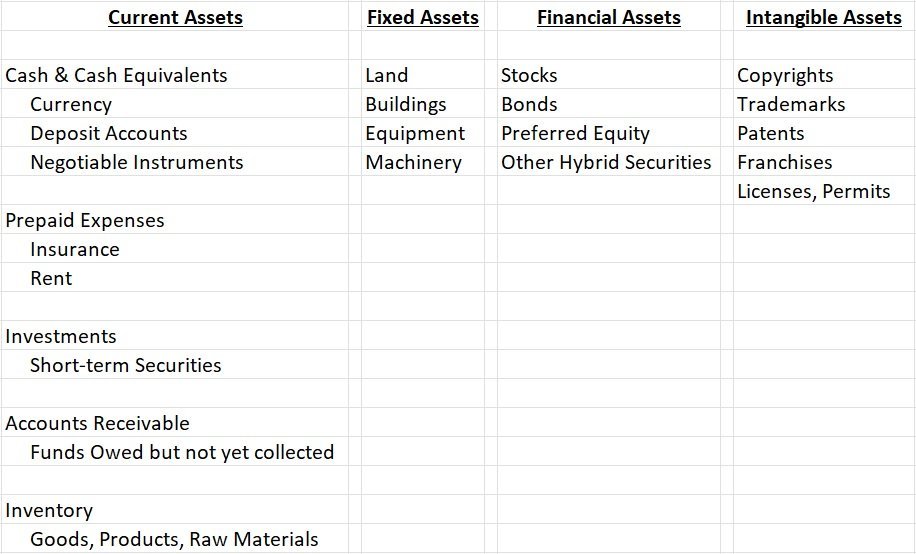

Summary of asset types:

Asset Type Classification

Classification is important for a variety of reasons. A business must understand and differentiate assets to effectively manage short-term and long-term cash flows.

Ensuring a business has available short-term liquidity, often referred to as current assets, allows the business to continue onward with its day-to-day operations. Inadequate liquidity can have disruptive consequences.

In addition, identifying long-term resources, referred to as fixed assets and financial assets, helps a business better understand its risks and long-term solvency outlook. Fixed and financial assets are long term plays for businesses that intend to remain in operation for years to come.

Assets in Accounting

Various accounting principles exist worldwide. Generally Accepted Accounting Principles (U.S. GAAP) is the most widely used accounting standard within the United States and is enforced by the U.S. Securities and Exchange Commission (SEC). It is widely present throughout American businesses.

In Financial Accounting, if legal control over assets exists, it is not necessary to be the owner of the asset to claim its economic benefits. Legal control represents one’s ability to benefit from an asset while restricting others from enjoying such benefits.

An example of this could be the leasing of a warehouse to produce goods within. The company leasing the space does not legally own the warehouse, yet they enjoy the economic benefits it provides.

Companies report assets on their balance sheet utilizing the accounting equation:

Assets = Liabilities + Equity

This widely used formula mathematically relates assets, liabilities, and owner’s equity.

Use of the accounting equation resulted in a concept known as double-entry bookkeeping, also referred to as double-entry accounting which dates back to the 15th century.