What are Accounting Principles?

Accounting principles are commonly established rules and guidelines organizations adhere to when reporting financial information.

The establishment of such rules and guidelines highlight the importance of accounting. Furthermore, consistent terminology and methodology help readers review financial information more easily.

With various accounting principles throughout the world, comparing financial statements from different countries can be difficult. International Financial Reporting Standards (IFRS) is the most used set of accounting principles worldwide. IFRS has been adopted in over 120+ countries.

Generally Accepted Accounting Principles (GAAP) are rules-based accounting guidelines adopted within the United States. GAAP was created by the Financial Accounting Standards Board (FASB).

IFRS and GAAP serve as the backbone which most accounting standards are built upon.

Reasoning behind Accounting Principles

Accounting principle frameworks seek to promote financial statements demonstrating completeness, consistency, and comparability.

With these qualities, third parties such as creditors, analysts, and investors can do the following more easily when reviewing an organization’s financial statements:

- Analyze financial strength

- Forecast future performance

- Decide to grant or not grant a loan

- Compare against competitors

Accounting principles help increase third party certainty surrounding financial statements. In addition, organizations are also able to detect fraud more easily due to increased transparency.

Completeness, Consistency, and Comparability

Accounting principles instill completeness, consistency, and comparability in the following ways:

Completeness ensures all asset, liability, and equity transactions are fully reported along with any related financial statement disclosures.

Consistency ensures financial statements are produced routinely and utilize the same accounting principles, rules, and guidelines for each accounting period unless otherwise stated.

Comparability ensures users can easily compare two financial statements side by side from two different companies while knowing similar accounting principles were followed.

Principled accounting frameworks help maximize certainty and transparency by minimizing errors and data inconsistencies.

Commonly used Accounting Principles

Regularly used accounting principles followed by organizations include:

Accrual Principle

States Accounting transactions should be recorded in the same accounting period they occur instead of periods in which cash flows are associated with the transaction. For example, an expense should be recorded in the accounting period in which it took place. It should not be recorded when the organization actually paid the expense, which could be several weeks or months later.

Conservatism Principle

States expenses and liabilities should be recorded as soon as possible. In addition, revenues and assets should only be recorded when the organization is sure they will occur. It is suggested expenses and liabilities be given recording priority to promote a conservative approach to financial statement reporting.

Consistency Principle

States once adopting accounting principles or methods, an organization should continue utilizing the same principles and methods to ensure consistency. Changes should only be made if other accounting principles or methods are identified as a better framework going forward.

Cost Principle

States organizations should record assets, liabilities, and equity investments at the original purchase cost. Over time, this principle has become more flexible as recent accounting practices support adjusting assets and liabilities to their face value.

Economic Entity Principle

States an organization’s transactions should be separate from the owner’s personal transactions or other businesses. Therefore, comingling assets or liabilities among different entities is discouraged and can create legal and auditing difficulties.

Full Disclosure Principle

States organizations should include all information affecting one’s understanding of their financial statements. Any additionally required information should be included within or alongside financial statements as well. These additional disclosures better explain the details behind financial statement data.

Going Concern Principle

States an organization is expected to remain in operation for the foreseeable future. This assumption justifies deferring certain expenses such as depreciation until future periods. Without the expectation of continued operations, an organization would be required to recognize all expenses at once.

Matching Principle

States when recording revenue, all related expenses should be recorded at the same time. For example, charging inventory for the cost of goods sold while recording revenue from the sale of inventory would be recorded simultaneously. The accrual basis of accounting utilizes this principle while the cash basis of accounting does not.

Materiality Principle

States all transactions should be recorded if not doing so may alter the decision-making process of an individual reading the organization’s financial statements. This commonly results in the recording of all transactions regardless of size.

Monetary Unit Principle

States an organization only record transactions that can be stated in a unit of currency. For example, the value of an inventory management system is not recorded. This principle keeps an organization from hypothesizing as to the value of its assets or liabilities.

Reliability Principle

States only provable transactions should be recorded. An auditor should be able to verify the origins of a transaction such as an invoice from a supplier. Transactions that are not provable via vouching should not be recorded.

Revenue Recognition Principle

States revenue should only be recognized and recorded once the earning process is complete. Organizations should record revenue when earned, not when collected. For example, if an organization enters into a transaction to sell inventory, once it ships out to the customer, it can record the revenue as earned.

Time Period Principle

States an organization should report results over a consistent timeline. This allows for a standardized set of comparable periods which supports trend analysis. For example, issuing quarterly financial statements in April, July, October, and January of each year allows third parties to analyze past, present, and expected future results more easily.

The above basic accounting principles are incorporated into several accounting frameworks such as IFRS and GAAP. The treatment and reporting of business transactions is expected to be consistent over time. Therefore, should an organization decide to change how they implement a principle or elect a new accounting framework, that change should be disclosed in the footnotes of the organization’s financial statements.

What are Generally Accepted Accounting Principles (GAAP)?

Generally Accepted Accounting Principles (GAAP) are a standardized set of guidelines followed by publicly traded companies within the United States.

These principles are developed by the Financial Accounting Standards Board (FASB), a nonprofit organization. Furthermore, members of the board are elected by the Financial Accounting Foundation (FAF).

Additional boards related to GAAP include:

Governmental Accounting Standards Board (GASB)- Sets GAAP standards for state and local governments.

Federal Accounting Standards Advisory Board (FASAB)- Identifies accounting principles for federal agencies.

Publicly traded companies listed on a stock exchange are required to file GAAP-compliant financial statements on a regular basis. In addition, Independent Certified Public Accountants and Chief Officers of these companies are expected to certify all financial statements were prepared in accordance with GAAP standards.

Privately held companies and nonprofits are not expected to follow GAAP guidelines. Although, GAAP-compliant financial statements may be required by lenders or investors. Many organizations follow GAAP guidelines even when it is not a legal requirement.

GAAP is sometimes compared with pro forma accounting. Pro forma is non-GAAP compliant and often utilizes projections or presumptions and may omit one-time nonrecurring expenses.

10 Key Accounting Principles of GAAP

GAAP includes ten key accounting principles known as rules-based standards. These standards take a blended approach by utilizing basic accounting principles and standards set forth by various accounting boards. GAAP aims to present a methodology that is useful across all industries which include the following principles:

1. Regularity of Principle

States accountants rigorously follow GAAP rules and regulations.

2. Consistency Principle

States the same standards shall be applied throughout the entire financial reporting process to ensure comparability between reporting periods. In addition, any changes in standards must be fully disclosed in the footnotes of financial statements.

3. Sincerity Principle

States accountants commit to impartiality and accuracy when portraying an organization’s financial condition.

4. Permanence of Methods Principle

States procedures used in the preparation of all financial reports are consistent.

5. Non-Compensation Principle

States all information relating to an organization whether positive or negative is fully reported without expectation of debt compensation.

6. Prudence Principle

States fact-based financial data is utilized without the influence of speculation.

7. Continuity Principle

States asset valuations also assume the organization will continue to operate.

8. Periodicity Principle

States reporting of entries like revenue is to be appropriately divided among standardized accounting periods such as quarterly or annually.

9. Materiality Principle

States financial reports fully disclose all financial data relating to an organization.

10. Utmost Good Faith Principle

States it is assumed all involved parties have acted with honesty throughout all transactions.

What are International Financial Reporting Standards (IFRS)?

International Financial Reporting Standards (IFRS) are accounting principles that outline how events and transactions should be recorded within financial statements. In addition, it remains the most widely accepted accounting framework throughout the world.

IFRS was created and is supported by the International Accounting Standards Board (IASB). The organization’s purpose is to ensure IFRS accounting principles are applied consistently on a global basis. This makes it easier when comparing financial statements worldwide.

IFRS is used by most members of the G20 and the European Union.

Differences between IFRS and GAAP

Several differences exist when comparing IFRS and GAAP accounting frameworks.

Characteristics of IFRS include:

- a standards-based approach

- viewed as ever-changing within the industry

- utilized internationally

Characteristics of GAAP include:

- a rules-based approach

- viewed as non-changing within the industry

- mainly utilized in the United States

Methodology differences that exist between IFRS and GAAP include:

Inventory: GAAP allows FIFO (first in first out) and LIFO (last in first out) as inventory cost methods while IFRS only allows the FIFO method.

Write-down reversals: GAAP does not allow the reversal of a fixed-asset or inventory write down if market value later increases. IFRS does allow the reversal of a write-down.

Intangible assets: GAAP recognizes intangible assets such as research and development (R&D) at fair market value while IFRS utilizes future economic benefits of intangible assets when determining value.

Fixed asset valuation: GAAP states organizations show fixed assets at cost net of accumulated depreciation while IFRS states an organization can revalue fixed assets.

Liability classification: GAAP specifies liabilities to be classified as current liabilities or non-current liabilities on the balance sheet. IFRS does not make this specification and considers all liabilities as non-current.

Although differences exist between GAAP and IFRS, their governing boards FASB and IASB often work together when defining accounting related topics.

When were Accounting Principles Established?

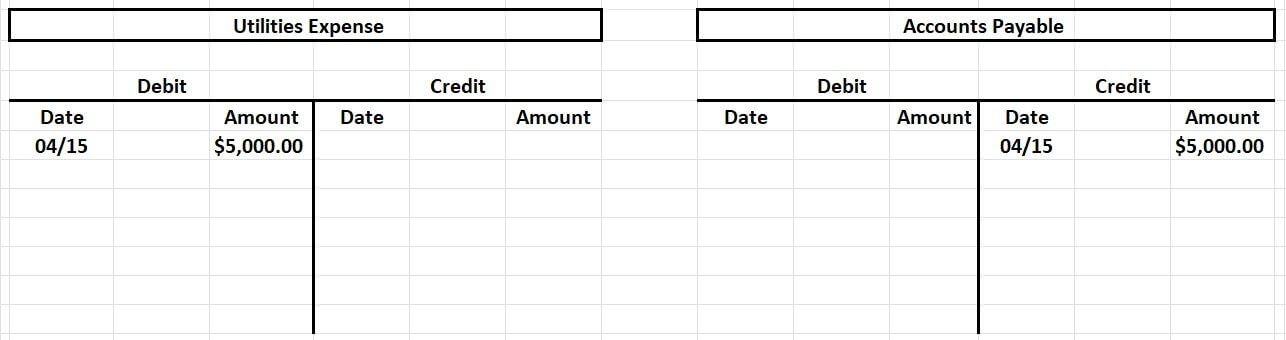

Accounting Principles date back to the 15th century with invention of the double-entry bookkeeping system commonly referred to as the T-ledger.

The T-ledger resembles the letter “T” in the alphabet and is referred to as a “T-account”. Accounting entries were recorded within the ledger by listing debits on the left and credits on the right.

Financial reporting improvements over the centuries have been credited by some scholars as being pivotal points in history. Moreover, it is believed these improvements have greatly contributed to worldwide economic growth.

Identifying GAAP Accounting Principles by Hierarchy

The below GAAP resources provided by The Financial Accounting Standards Board (FASB) supply accountants with a basic framework to follow when GAAP-related accounting questions arise.

Accountants are expected to research answers utilizing the below resources in ascending order. For example, if they are unable to locate an answer utilizing resources listed under level one, they would move on to level two, then level three, and lastly level four.

Authoritative broader-issued guidance is presented first followed by technical-related topics.

1st level: Statements from The Financial Accounting Standards Board (FASB) OR Accounting Research Bulletins & Accounting Principles Board Opinions issued by The American Institute of Certified Public Accountants (AICPA)

2nd level: Technical Bulletins from The Financial Accounting Standards Board (FASB) OR Industry Audit & Accounting Guides & Statements of Position issued by The American Institute of Certified Public Accountants (AICPA)

3rd level: Accounting Standards Executive Committee Practice Bulletins issued by The American Institute of Certified Public Accountants (AICPA) OR Positions of The Financial Accounting Standards Board (FASB) Emerging Issues Task Force (EITF) OR Topics Discussed in Appendix D of Emerging Issues Task Force (EITF) Abstracts

4th level: Implementation Guides Published by The Financial Accounting Standards Board (FASB) OR Accounting Interpretations published by The American Institute of Certified Public Accountants (AICPA) OR Industry Audit and Accounting Guides & Statements of Position not cleared by The Financial Accounting Standards Board (FASB) OR Widely recognized Accounting Practices commonly accepted and followed throughout the industry.

This framework is addressed in greater detail within FASB’s Statement of Financial Accounting Standards No. 162.